How Satispay Promotes Financial Inclusion for All Users

How Satispay Promotes Financial Inclusion for All Users

Introduction

Financial inclusion is essential for the economic growth and well-being of individuals and communities. Unfortunately, many individuals and businesses face barriers when it comes to accessing and using financial services. However, Satispay, the innovative payment platform, is revolutionizing the way people carry out financial transactions, promoting financial inclusion for all users. In this blog post, we will explore how Satispay is breaking down barriers and making financial services accessible to everyone.

1. Easy and Convenient Mobile Payments

What is Satispay?

Satispay is a mobile payment platform that allows users to send and receive money instantly using their smartphones. It eliminates the need for physical cash or cards by allowing users to make payments directly from their bank account. This convenience makes it accessible to a wide range of users, including those who are unbanked or underbanked.

How does Satispay promote financial inclusion?

Satispay promotes financial inclusion by providing a simple and user-friendly solution for making mobile payments. Users only need a smartphone and a bank account to start using the platform. This eliminates the need for a traditional bank account or credit card, making it accessible to those who may not have access to traditional banking services.

Are there any fees associated with Satispay?

Satispay aims to promote financial inclusion by offering a fee-free service for users who use the platform for personal transactions. This means that individuals can use Satispay without worrying about additional costs or hidden fees. However, businesses may be subject to small transaction fees based on their usage and features required.

2. Financial Education and Awareness

Does Satispay provide financial education?

Yes, Satispay understands the importance of financial literacy and provides resources and educational content to help users make informed financial decisions. Through its blog, social media channels, and newsletters, Satispay offers tips, guides, and insights into personal finance and money management. By increasing financial knowledge, Satispay encourages users to take control of their finances and make better financial choices.

How does Satispay raise awareness about financial inclusion?

Satispay actively raises awareness about financial inclusion by partnering with local communities, NGOs, and social projects. The platform promotes the importance of bridging the financial gap and works towards reducing financial exclusion. By collaborating with various organizations, Satispay advocates for equal access to financial services, empowering marginalized individuals and communities.

3. Merchant Support and Digital Transformation

How does Satispay support merchants?

Satispay not only benefits individual users but also supports merchants by providing them with a secure and cost-effective payment solution. Merchants can easily integrate Satispay into their existing point-of-sale systems, enabling them to accept cashless payments efficiently. By offering a seamless payment experience, Satispay helps businesses reach a broader customer base while simplifying their financial operations.

Does Satispay help in the digital transformation of businesses?

Yes, Satispay supports businesses in their digital transformation journey. By offering innovative payment solutions, Satispay encourages businesses to embrace digital technologies and move towards a cashless society. This not only improves efficiency but also opens doors to new opportunities and revenue streams.

Conclusion

Satispay is bringing about a paradigm shift in financial services by promoting financial inclusion for all users. With its easy-to-use mobile payment platform and emphasis on financial education, Satispay is breaking down barriers and empowering individuals and businesses to take control of their finances. By providing accessible and cost-effective solutions, Satispay demonstrates its commitment to building a more inclusive financial ecosystem.

FAQs (Frequently Asked Questions)

1. Is Satispay available worldwide?

Currently, Satispay is available in Italy, Luxembourg, and soon expanding to other countries. Users can check the Satispay website or app store for the latest information on availability in their region.

2. Can I use Satispay if I don’t have a bank account?

Satispay requires users to have a bank account to link to the app. If you don’t have a bank account, you may need to explore alternative financial services that cater to individuals without traditional banking options.

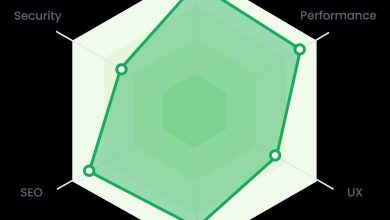

3. How secure is Satispay?

Satispay takes security seriously and uses industry-standard security measures to protect user’s financial information and transactions. This includes encryption, two-factor authentication, and secure servers. Users can also set a PIN or use biometric authentication to enhance security.

4. Can I use Satispay for online purchases?

Yes, Satispay can be used for both in-person and online purchases. It offers a seamless payment experience for e-commerce transactions, allowing users to complete purchases with just a few clicks.

By combining accessibility, financial education, and improved merchant support, Satispay is paving the way for a more inclusive financial ecosystem. Whether you’re an individual looking for a simple payment solution or a business aiming for digital transformation, Satispay is redefining financial inclusion for all users.